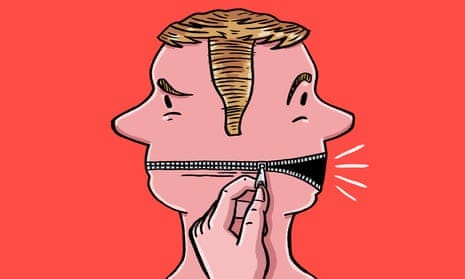

FREEDOM OF EXPRESSION IS INDIVISIBLE

HMRC acting unlawfully in gagging communication of lawful information and ideas

HMRC Was Warned

The common law of England, and the Human Rights Act 1998, both protect the constitutional right to communication of lawful ideas and information.

The protection of that freedom is indivisible.

As Lord Justice Sedley stated in Connolly v DPP [2007]:

Free speech includes not only the inoffensive but the irritating, the contentious, the eccentric, the heretical, the unwelcome and the provocative provided it does not tend to provoke violence. Freedom only to speak inoffensively is not worth having. What Speakers’ Corner (where the law applies as fully as anywhere else) demonstrates is the tolerance which is both extended by the law to opinion of every kind and expected by the law in the conduct of those who disagree, even strongly, with what they hear. From the condemnation of Socrates to the persecution of modern writers and journalists, our world has seen too many examples of state control of unofficial ideas. A central purpose of the European Convention on Human Rights has been to set close limits to any such assumed power. We in this country continue to owe a debt to the jury which in 1670 refused to convict the Quakers William Penn and William Mead for preaching ideas which offended against state orthodoxy.

Judicial Review Claim Against HMRC

HMRC has not the power to act as censor of lawful ideas and information:

Whether HMRC disapproves of the lawful ideas and information, is irrelevant.

Whether HMRC dislikes the author of the lawful ideas and information, is irrelevant.

Read the Claim in full here:

KEY ALLEGATIONS

Purported Power Granted to HMRC to Gag and Censor

54. Parliament purports by Part 5 Finance Act 2014 to have granted to the Defendant HMRC a worldwide statutory power to censor, prohibit and limit, by arbitrary fiat, on pain of financial and criminal penalties, that constitutionally guaranteed freedom in the United Kingdom: (i) to express and communicate information and ideas; and (ii) to receive information and ideas.

55. Part 5 Finance Act 2014 appears to limit an individual’s ability to publicise matters which are: (i) entirely lawful; (ii) concern matters of law, practice and policy; (iii) propositions of law inherent in which, may be upheld as correct in law by His Majesty’s Tribunals and Courts, and still fall subject to the said censorship; and (iv) which do not fall within any constitutionally permitted derogation.

56. This Claim accordingly concerns a state of affairs in which HMRC wishes to exercise worldwide a statutory power to prohibit, worldwide, any communication or receipt of ideas and information which HMRC chooses to dislike: (i) even though the subject matter of such discourse is wholly lawful; and (ii) even though propositions of law included in such discourse my be upheld as correct in law by His Majesty’s Tribunals and Courts.

57. Since the law enacting such censorship power has effect, even though propositions of law included in such discourse my be upheld as correct in law by His Majesty’s Tribunals and Courts, HMRC cannot properly aver that such law is necessary in furtherance of the protection of the public revenue.

58. The necessary effect of the said purported statutory provisions is: (i) to circumvent and make nugatory all the statute and common law of this jurisdiction; (ii) to replace the same with the arbitrary subjective opinions from time to time of HMRC “authorised” officers.

The Constitutionally Guaranteed Right to Impart and Receive Information and Ideas

59. There is freedom in the United Kingdom: (i) to express and communicate information and

ideas; and (ii) to receive information and ideas:

a. That freedom is indivisible.

b. That freedom is constitutionally guaranteed at common law and under Convention

rights.

c. That freedom is so guaranteed because it is the necessary foundation of a civil

democracy under the rule of law and accordingly is a fundamental element of the

rule of law.

60. Parliament is subject to the rule of law. The organs of State, such as HMRC, are subject to the rule of law.

61. Derogation by Parliament from the said indivisible freedom is constitutionally permitted:

a. At common law only to prevent criminal conspiracy, incitement to crime and

disorder, and malicious communication. Categories of criminal incitement are

already established by statute, with extension in civil law to the tort of harassment.

b. In Convention law, only on grounds of national necessity, the bounds of which

necessity are set by categories stated in the Human Rights Act 1998.

62. Outwith such limited derogations:

a. Parliament has not the power to enact legislation contrary to the rule of law.

b. No organ of the State can exercise any power purportedly legislated by Parliament,

which is contrary to the rule of law.

63. On the assumption (which is denied) that HMRC has given a Statutory Giving of Notice Before Publication

a. Parliament had not the power to grant by statute to HMRC any power to prohibit,

censor or constrain the expression and communication of information and ideas:

b. Common law protects absolutely the freedom to express and communicate

information and ideas about matters which are lawful, such as opinions as to the

laws of the United Kingdom.

c. Provisions of the Human Rights Act 1998, which are of mandatory effect, protects

absolutely the freedom to express and communicate information and ideas about

matters which are lawful, such as opinions as to the laws of the United Kingdom.

64. Accordingly, HMRC had not and could not be granted power prohibit, censor or constrain the expression and communication of information and ideas.

65. Any purported grant of any such power to HMRC was ultra vires the common law and provisions of the Human Rights Act 1998, and accordingly was unlawful.

66. Further, whilst the books historically written by the Claimant remain on sale. It is arguable that in order to comply with the requirements of Part 5, the Claimant would be required to:

a. Seize any such book on sale, or ever sold.

b. Burn them to the satisfaction of HMRC.

67. Further, in seeking from the Claimant written submissions on matters relating to hypotheses set out in Stop Notice 50, to the Further Independent Review into the Loan Charge, the Reviewer may be alleged to have been inciting and encouraging an apparent breach of Part 5.

68. this censorship state of affairs is absurd and irrational, which absurdity and irrationality arises from: (i) HMRC attempting to use unlawful powers; (ii) unlawfully to trespass upon the constitutionally guaranteed freedom to communicate information and ideas about matters which are in themselves wholly lawful.

WHAT NEXT?

HMRC must now file a Defence.

The world will then see how HMRC seeks to justify in law its assertion of a power to gag exercise of the constitutional right to communication of lawful ideas and information.